It Is Hard To Believe In Something You Never Experienced

Most founders who claim “we already tried this approche” fall into one of two traps: they either extrapolate from a tiny, poorly designed attempt, or they never act at all and still speak as if they had real experience. In both cases the result is the same: they don’t believe in a path they’ve never truly walked. This piece explains how that false sense of experience is born, and why stepping into the actual experience, as our clients have already done, is easier than believing in some rare numinous event, because this experience can simply be repeated instead of being endlessly theorised about.

My colleague shared with me an email exchange with a successful businessman from Florida. It helped crystallize one seemingly simple, but in fact deeply revealing point: as it turns out, many of you have simply never had a real opportunity to put your offer in front of a truly large number of the richest people on the planet.

Some of you think you’ve had that experience, but never stop to ask what “a lot” actually means in a statistical sense. You’ve maybe contacted, say, 50, 100, 300 billionaires, got no result, and concluded: “We tried, it doesn’t work.” Then you calmly extrapolate this tiny dataset in your head to a universe of 1,000 or 2000 people: “If no one bought out of a hundred, no one will buy out of a thousands either.”

In that moment, the entire question of quality and depth of those contacts is simply erased from your mental model. While on digital platforms, you behave completely differently, constantly trying to reach as many irrelevant people as you can.

Others don’t even get that far. They just theorize about the process in very abstract terms, saying things like: “We could do that if we set it as a goal.” Only you don’t set it as a goal — because you’re either infected by a common misconception, or have found a very convenient excuse not to try or not to invest. Whoever does it, your team or ours, it will cost money. Building and managing this kind of database takes time, and that time has to be paid for.

Neither group has a clear picture of reality. That’s where your confusion comes from — confusion we for a long time interpreted as “negative experience”. But this correspondence pulled back the curtain: in most cases you don’t have a bad experience. You have no meaningful experience at all.

Someone will say you can’t generalize from a single email thread — and they’ll be right. But behind that one exchange stand many others. This one just went deep enough to illuminate the structure of a pattern that repeats across hundreds of conversations with similar players.

And if you feel like objecting — great. Just write and tell us that you have personally reached out, one-to-one, to more than half of the global billionaire population and actually ran that experiment at scale. Then we can talk as peers.

If not, and you belong to the group that either theorizes or extrapolates a tiny, local experience to vastly larger scales — then, unfortunately, you simply don’t have the necessary experience to draw the kinds of conclusions you’re drawing.

Hard, but not impossible

This is, in fact, a very interesting situation. But at the same time, it’s a dead end. It’s like trying to develop sincere faith in a numinous, mystical experience in the same way you “believe” in the experience of zero gravity. The analogy isn’t perfect, but it serves one purpose: to show that there are types of experience that you won’t truly believe in — even if you know some number of people have gone through them.

You either don’t believe, or you keep theorizing — like with gravity, observed only on paper.

This is an almost perfect explanation of why, despite the fact that we have long-term clients, some of them working with us for many years, and many of them well known in their own industry segments, this changes almost nothing in negotiations.

In most other businesses, that kind of client roster would work like a giant magnet, pulling new clients in. Here? Not really.

The comparison still holds. Imagine you meet someone who has had a genuinely numinous experience — and they even let you speak to others who’ve had something similar. This still won’t automatically turn you into a devoted believer.

Gravity is simpler: at least there you can run an experiment. If you have enough money, you can literally buy yourself a few minutes of weightlessness with Blue Origin or SpaceX, feel your own body fall out of the grip of gravity, and never again argue about whether zero gravity is “real” or just an idea on paper.

To really believe, you need to live through a personal experience.

But unlike numinous experience, which is almost impossible to reproduce on demand, here you actually have the option, exactly as with the “reduced gravity” analogy, to repeat what our clients have done: interact with that volume of wealthy people, feel the magnitude of the reach, and see the result with your own eyes. But unlike those two space tourism giants, our service will cost you a fraction of the price — and instead of the observer effect, thrilling emotions, and a few photos for your family or online album, it will put you on a path toward real, measurable financial returns.

Everybody like this

Another thing that stood out in that email thread was a very common pattern: potential clients wanting to shift the financial risk onto the service provider. In today’s world, this doesn’t just look naïve, at times it’s frankly a bit humiliating to watch.

Don’t get me wrong: there’s nothing inherently bad about managing risk. On the contrary, it’s a clever strategy. And as long as there are people on the market who will grab at any opportunity, willing to take risks and spend their time pushing someone else’s products in exchange for a hypothetical upside, this model will continue to exist.

The problem is, this severely complicates life for those who have zero interest in such experiments, because decades of practice show: this is not the most reliable format for collaboration.

No self-respecting company will work with you purely on a profit-sharing basis, without any control over the asset, the sales process, or at least a fixed fee for organizing the work.

Imagine if you only had to pay Google, Facebook, or LinkedIn for advertising if you closed a deal. That would be perfect. Unfortunately, that’s not how the world works.

No one wants to assume the risk of outcomes that are, by their nature, unpredictable. It’s your product, your team, your positioning, your pricing — what does any of that have to do with the company that distributes your content?

And the fact that your first impulse right now is to be offended by this comparison only shows how close it actually is in scale. These digital giants like to boast that they “cover” four billion people — roughly half of the planet. No one can verify that number, of course, but it sounds impressive on a slide.

Our database also covers “half a population” — only not half the world, but roughly half of the billionaire universe. In that sense, we’re not that different: at the level of ultra-expensive assets, if you’re focused on real sales rather than populism and vanity metrics, you don’t need abstract “reach”, you need actual buyers. Not “dead souls” in the Gogol (reed Google, Facebook or LinkedIn) sense, and not the kind of inflated user base Elon Musk discovered after buying Twitter, but real, identifiable individuals who can actually execute a $50M+ transaction.

You’ve either heard this or said it to someone else

From the other side of the barricade, your side, the same argument keeps coming back:

“If you’re so confident in your service, you have nothing to fear. You’ll earn far more in commissions than you would on your regular fees.”

The moment you hear this, you instantly understand the cognitive level in the room.

If this touched a nerve because you’ve said something like that yourself, or tried to force such terms on someone, don’t be shy, you’re welcome to leave a comment. We’ll be happy to reply.

It sounds off-putting for a very simple reason: you need to understand who you’re saying this to.

First, no matter how high you fly in your segment, it doesn’t mean people owe you free work — or “work for a chance at something someday”.

Second, everyone has their own job. A mailman delivering letters is responsible only for getting the envelope to the right address on time. He is not responsible for what’s inside that envelope — and certainly not for how the recipient reacts to its contents. This should be obvious to everyone.

Yet some people genuinely seem to believe (and this is both funny and a little sad) that there can be a model in which the mailman gets paid only if the content of the letter interests the recipient so much that they make a purchase.

As if the work itself never happened — or doesn’t count.

If we translate this into your world, it sounds like this:

“Let me sail your yacht around the Mediterranean for a week. If, thanks to that, I manage to seduce Miss Universe — or at least someone of comparable beauty — I’ll definitely pay you.”

Or something even more ridiculous.

I can almost physically feel how some of you are, right now, spraying your phone screen or monitor with indignant spit, mumbling to yourselves: “That’s completely different!”

Is it, though? To me, it’s exactly the same.

Desperation Becomes a Business Model

However, as long as there are people in despair on the market, people who deep down don’t believe in results, or those who have automated their “envelope delivery” process so heavily that it costs them almost nothing, these stories will keep happening.

And they will keep giving others the illusion that such arrangements are normal, and that it’s reasonable to propose collaboration models where all financial responsibility sits on the service provider’s shoulders.

And if only we lived in a perfect world where people always keep their promises. But we don’t.

Even if you faithfully do your part of the deal, you can easily end up with nothing, because the service provider controls nothing in your value chain.

Cases of broken agreements happen even where there are official exclusive mandates. Talk to brokers who were simply not paid by asset owners who chose to sell directly, or through different brokers representing the buyer’s interests.

How many such cases are there? More than enough to stop behaving like a naïve simpleton.

What about trust?

Someone will inevitably ask again: “What about trust? If you don’t trust anyone, how can we trust you?”

This is playground-level thinking.

We don’t need you to “take us at our word”. Every claim we make has formal backing. There is a clear, documented process that leaves no room for interpretation.

You get exactly what’s included in our service package. No more, no less.

The essence is simpler and less romantic: you, like many others, just don’t want to take on the risk associated with what you are selling. And you’ve found a way to shift that risk onto others — not because you’re evil, but because that’s how the market is currently structured.

A lot of people came into it recently with their automation, free trials, referral schemes, and other tools that work perfectly in low-cost segments. You got used to that environment and now expect the same behavior from everyone. Forgetting that you are selling assets affordable only to a tiny group of people.

No one is stopping you from following that strategy. If you manage to get your process going without paying a cent — congratulations.

But we are not talking here about building an army of free labor, chasing hypothetical rewards while they look for buyers on your behalf. We’re talking about actual sales.

To be fair, this model can produce results. But in the end you pay more (assuming you’re an honest player who actually honors your promises), while sticking to your main point that I’m supposed to earn more in success-fee commission than I charge as a service fee — and you drown in unnecessary chaos and wasted time along the way. There are far more rational ways to do business.

One of the strongest arguments in favor of our strategy comes from the market itself. In the market for ultra-high-value assets, there are no random buyers. Long before you launch any sales process, everyone who could buy is already known — and there are not many of them.

Read that again.

Your potential buyers for assets priced above $50M form a finite, limited set of people. There are not that many of them, objectively speaking.

If you reach all, or almost all of them, success becomes a matter of time — mainly a matter of building the right information field around you and your product, and accumulating enough credit of trust. That’s it.

What has always surprised me is doubt directed at the strategy itself. How else, exactly, is this supposed to work?

If you don’t believe your product can be sold even after you’ve reached a large share of all possible buyers, then the problem is either with your belief in yourself — or with the product.

Let’s do this on fingers, as they say.

Suppose there are only 100 people in the world who can buy your product, and that’s objectively true at any given moment. On the $50M+ asset market, the number of such buyers is finite. This is not the $20 underwear market.

So if you’ve shown your product to 80–90 people who can realistically make that purchase in the medium term, and in total have reached essentially everyone globally who could afford it — meaning several thousand people — and none of them agreed to buy, assuming you have sufficient recognition in that circle, then there is a very high probability that something is wrong.

Wrong with your product (pricing, quality, age, location, novelty, etc.), or wrong with the market right now.

In the first case, you can act: lower the price, restructure the offer, add value — make the proposition more attractive.

In the second, when the problem is the market, there’s nothing to do but wait. But in the long run, this strategy always works. It’s just a question of time.

If you have only one asset to sell, this may feel painful. But if you have a portfolio, your probabilities shift dramatically — and results tend to arrive much faster.

Our service does not guarantee you a sale tomorrow — or by some date you circled in your calendar because you like how it sounds.

What our service guarantees is direct access (no noise, no intermediaries) to the audience that can actually make that purchase. Every contact in that audience is worth working with in depth, building familiarity and trust — especially if these people don’t know your brand yet. Because even a single transaction in this segment makes you rich — not for life, but for the coming years.

I cannot force you to believe in an experience you’ve never had.

No matter how much I’d like to convince you that this experience will be beneficial to you, in the end these are still just words. Every business uses words, meanings, and imagery to attract attention.

But there are empty words, which sound very impressive:

“We guarantee you this and that.”

“With us, you’ll achieve success in record time.”

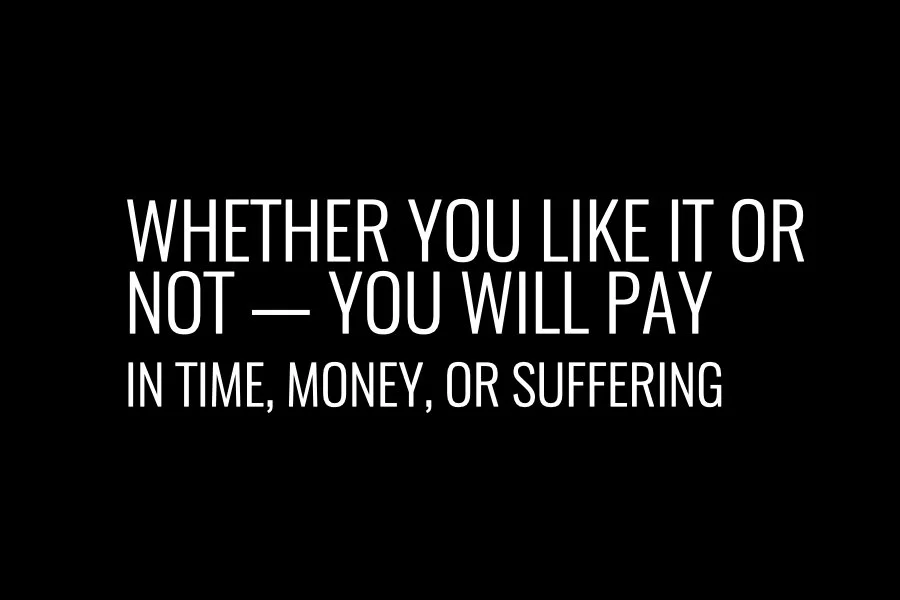

And there are words that, whether you like them or not, simply state the truth:

without the necessary level of investment and the necessary duration of effort, there will be no result. Everything else on our side is already in place.

If you don’t want to pay, or want to pay less than the work objectively costs, you’re either living in an illusion — or you’ve just found the explanation for why your sales are so disappointing.

This message is for those who are not satisfied with their sales.

Because everyone who is satisfied is currently doing something far more pleasant than reading this long, tedious, but brutally realistic text. If you’ve read this far, you’re not one of them.