I’m glad that “all of you” have common sense

Of course, I would prefer this article to be wrong: that would vastly simplify UHNWI prospecting. Unfortunately, the grim truth is that what follows not only reflects the harsh reality of how difficult this process is, it also exposes the depth of your misconception—and your blind faith in the “magic” of platforms.

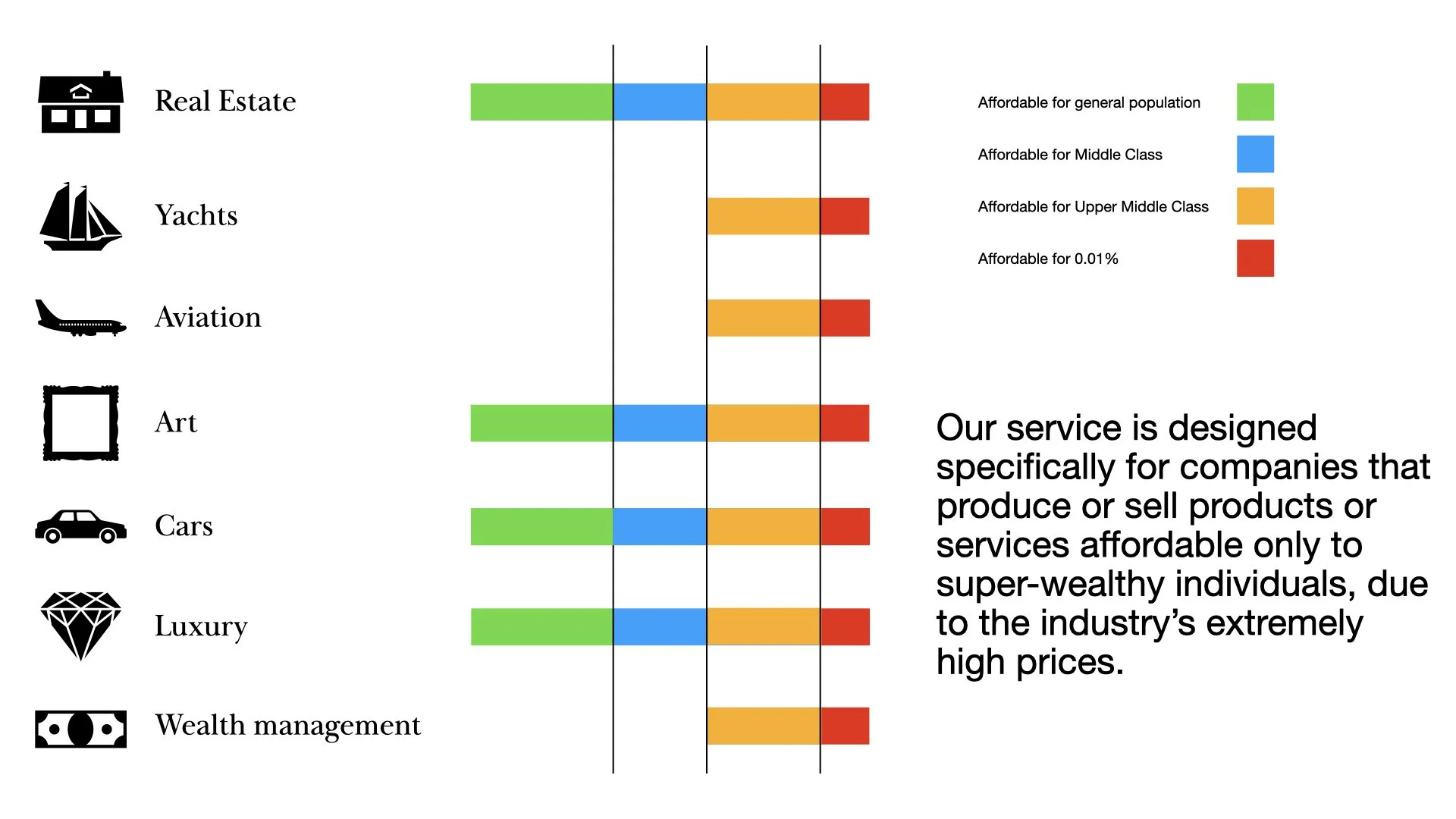

In many product categories there are mass-market price bands and premium bands available only to the very wealthy. There are watches for $20 and watches for $2M. There are also categories in which the entry price is inherently aimed at very rich buyers: mid- and long-range private jets, super- and mega-yachts, etc. Our service was built exclusively for ultra-expensive goods and services where standard promotional methods fail because targeting is hard. This is our core specialization.

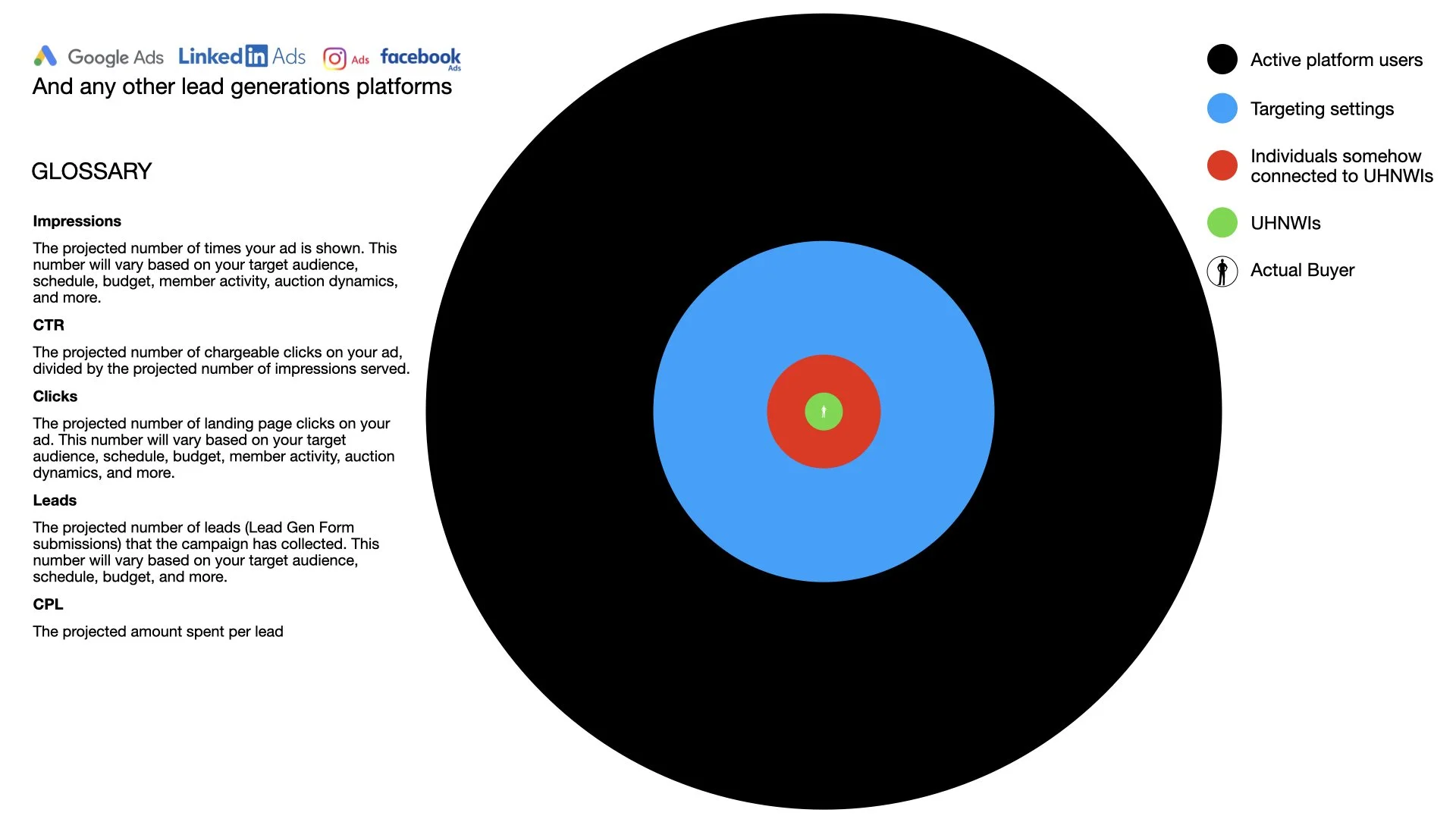

If you operate in this market, you have surely asked: how many real buyers are there right now in the world for an asset priced above $50M? Whether it’s an aircraft, a house, or a yacht doesn’t matter. No one can name a figure accurate to the single person, but even with all optimism—no more than 100 people. You can object, but only in the downward direction. If you believe that, at this very minute, there are more, you have likely chosen the wrong line of work.

Assume these 100 people are distributed across the broader population who, by virtue of their capital, could in principle afford such a purchase—around 10,000 people—and perhaps another 15,000 “with a stretch” and on some longer time horizon. Right now, it’s no more than 10,000, and only a hundred of them are ready to take serious steps if all criteria are met. In other words: a small group within a small group.

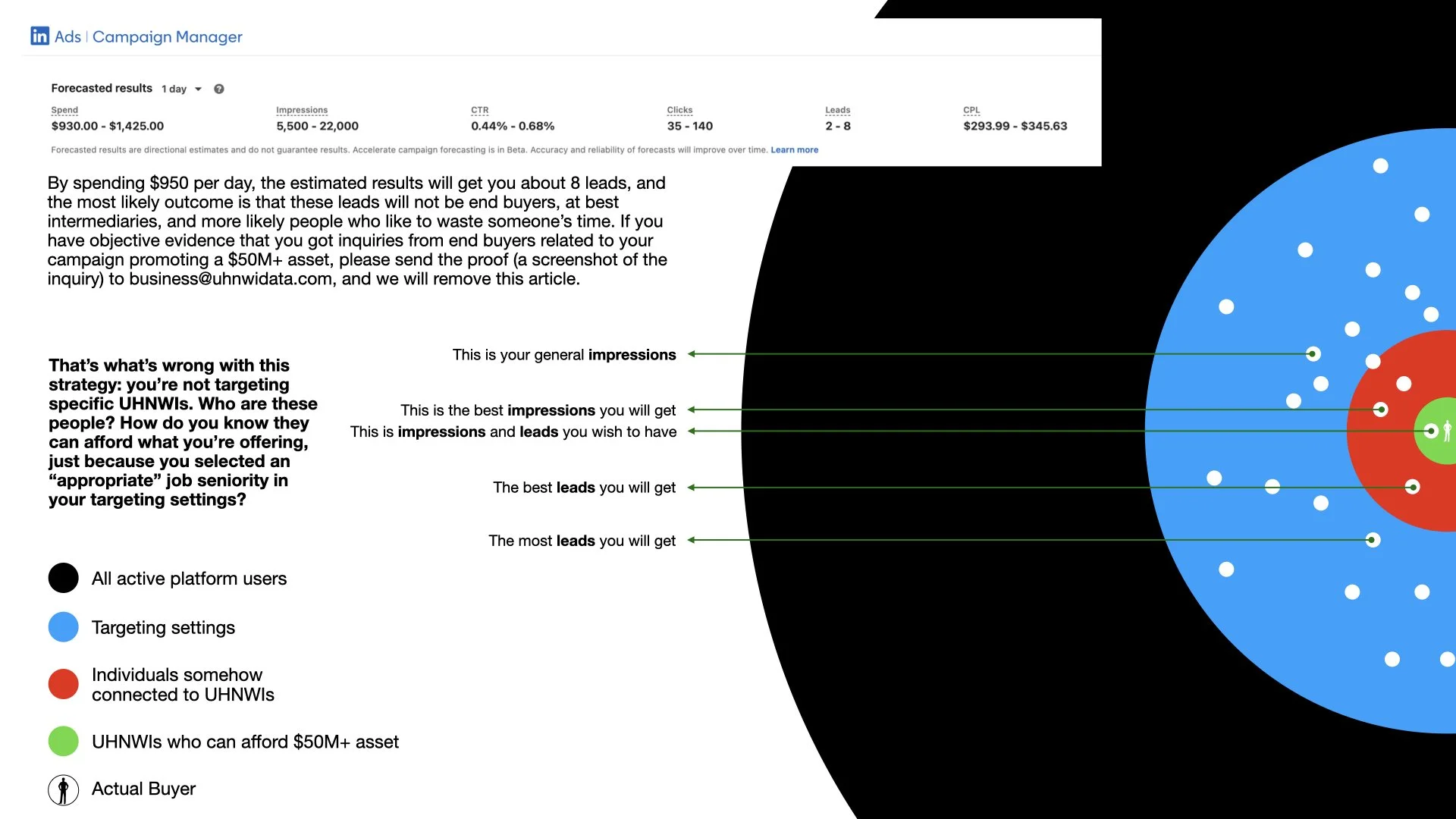

We do not claim a deep understanding of every nuance of platform architecture, but based on the platforms’ own descriptions of their services, some conclusions are obvious. I’m afraid you may not like the result. Given that almost everyone uses digital platforms to promote themselves, their brands, products, or services, it’s reasonable to assume some of you spend at least $1,000 per month. Of course, the true figure is often higher, but for the sake of a clean example we’ll stop at $950. Let’s see what the basic platform offer includes—and why.

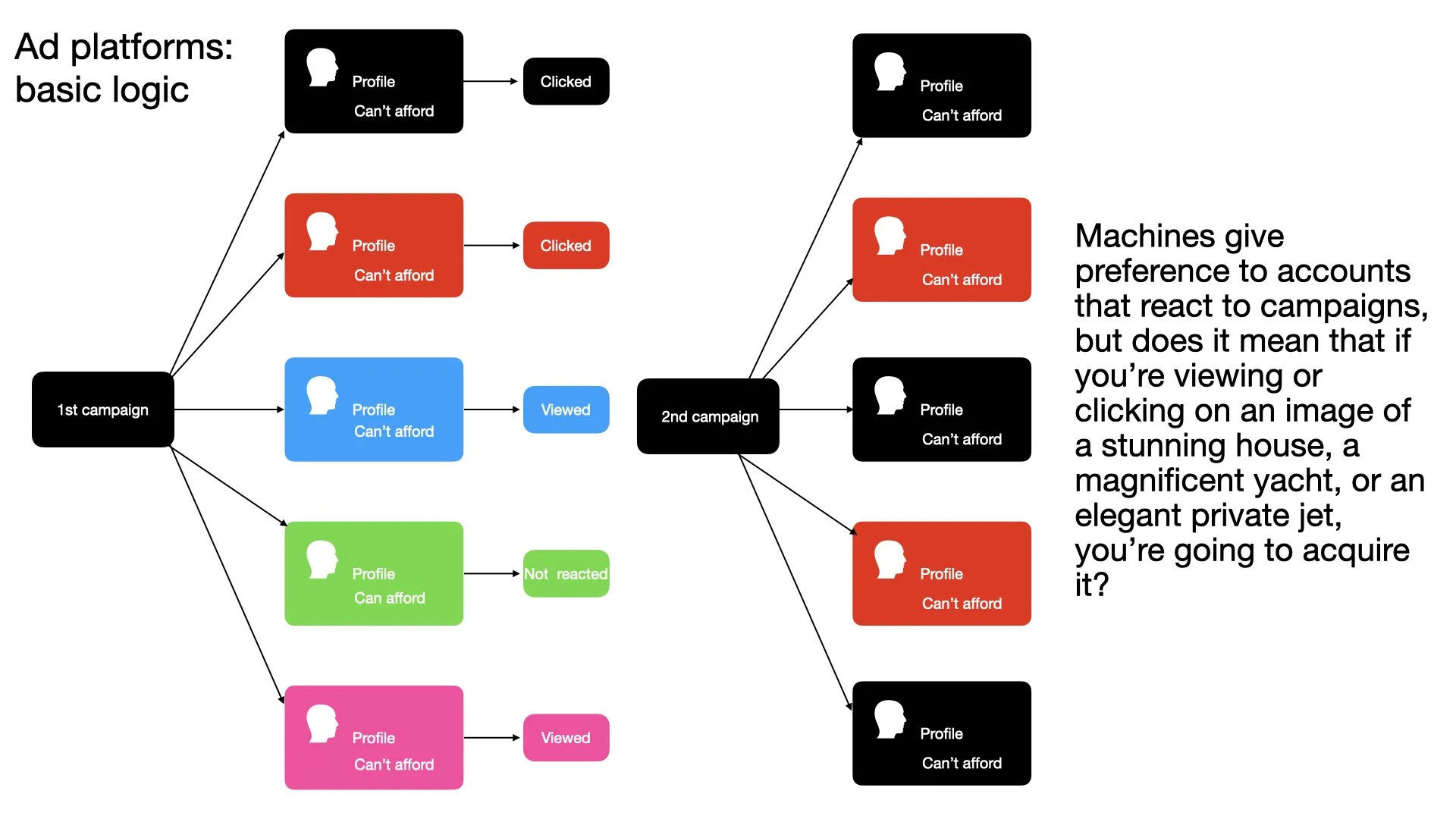

The magic of marketing is that the client is always offered a forecast grounded in statistics gathered from prior measurement exercises. The basic metric set is familiar: Impressions, CTR, Views, Clicks, Leads, CPL. But what do these mean for our task—selling a $50M+ asset? First, even if platforms have UHNWI profiles among registered users, that does not mean those accounts are operated by the individuals you actually care about; and if they are, they are unlikely to be used for consuming ads. Many platforms explicitly sell subscriptions that disable ads. Even if we ignore this nontrivial fact and assume your buyer is on the platform and reachable via built-in ad tools, you will face problems of targeting and reach. A platform may have vast numbers of people, but you should only care about those who can truly afford what you sell. Unfortunately for you—and fortunately for us—none of these platforms provides targeting by net worth. It is replaced with very indirect proxies for wealth, which inflates the audience. Don’t assume this is accidental or that they “can’t” do better—it’s simply unprofitable for them. It’s far more lucrative to let you reach a gigantic audience with no budget cap than to give you only those who can afford your offer, because that group is limited.

Let’s look closer. We created a test lead-generation campaign on LinkedIn with a $950 budget/per day. Targeting criteria: USA, Owners and CXOs only. Based on those inputs, the platform projected Impressions: 5,500–22,000—“the projected number of times your ad is shown. This number will vary based on your target audience, schedule, budget, member activity, auction dynamics, and more.” In other words, your ad will appear in the feed—alongside hundreds of other messages—to some business owners and CXOs in the USA. Encouraging, isn’t it? Next, they say you should expect 35–140 clicks—“the projected number of landing page clicks on your ad.” And there is absolutely no confidence that these clicks are from people even remotely resembling a real buyer. How many times have you personally clicked something out of curiosity, or by accident, with zero intention to buy because it’s simply beyond your budget?

What does that even mean, and why should it matter? How did they manufacture a correlation between clicks and a forecast of real sales? The YouTube video “Inside the MOST EXPENSIVE and HIGHEST Penthouse In the WORLD!” about a $250M apartment racked up 16M views. How many of those viewers can afford such real estate? The video was posted two years ago; the price has since been cut to $195,000,000—and the apartment is still unsold. So what difference do views and clicks make? There is only one relevant metric: sold / not sold. Sales come from conversations and meetings with potential clients. Which brings us to the next platform metric—Leads: 2–8—“The projected number of leads (Lead Gen Form submissions) that the campaign has collected.” In other words, it is expected that 2–8 people will fill out some form. The first question is: on what basis is this calculation made—purely statistics? Do they have a ready-made solution if no one bites? Or is it printed somewhere in small type that this is merely a projection and they do not guarantee any such result? One hopes it’s the latter—which means you are implicitly prepared for the outcome in which your campaign yields zero concrete inquiries. But if inquiries do arrive, it is critical to see who is sending them.

Around wealthy individuals there are always many who try to parasitize on their prosperity. If you’ve been in business long enough, you’ve heard it countless times: “I have a client…” Most such conversations lead nowhere, although specialists insist that “most deals are broker-to-broker.” Not surprising, is it? Your strategy primarily blankets the intermediary market, and since some portion of those intermediaries do have some contact with potential buyers, deals do occur. Your faith in platform advertising hinges on that sliver of reality. Yet there is a more direct and effective solution.

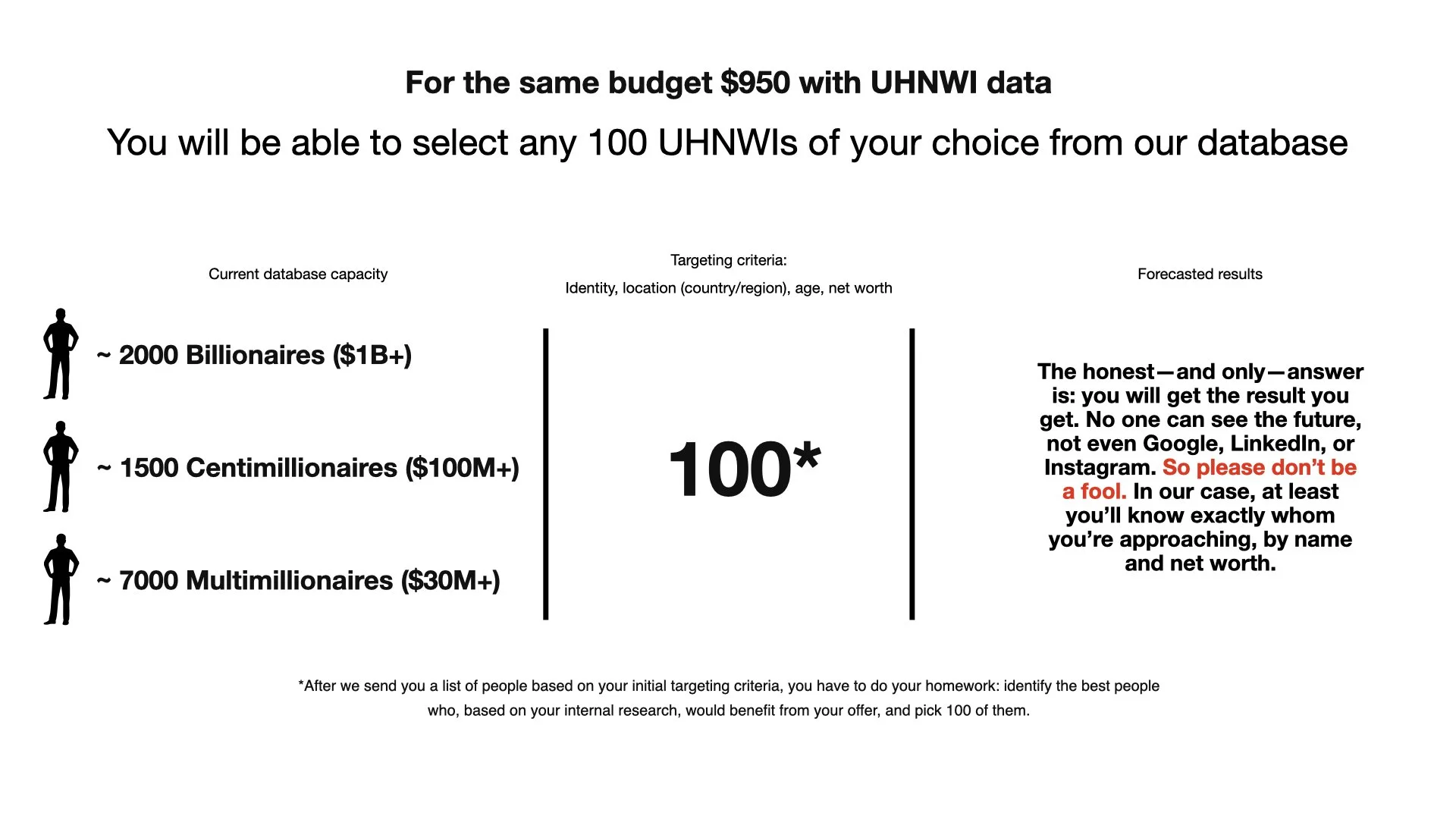

Take the same $950 budget. With our service, you can select 100 people from our database—including 2,000 billionaires, 1,500 centi-millionaires, and 7,000 multimillionaires—and send them your promotional message. You will choose the specific people who, in your judgment, are likely to be interested—based on your analysis, not on generic job-title targeting. By selecting real individuals, you materially increase your probability of success. Yes, you have to work: research and study the audience. That is called working—not clicking and typing in a credit-card number. Unlike the platforms, we will not instill hope in “Leads: 2–8,” because in the ultra-expensive segment the situation is inherently unpredictable: you must land on someone who is interested precisely now. To improve your odds, you need to reach far more than 100 people. But it is perfectly reasonable to test your strategy and content on a small, carefully pre-sorted group before you roll out large-budget, multi-platform campaigns. Obviously, you should not expect a single 100-person mailing to sell a $50M+ asset—that would be a miracle. What you will get is an initial reaction to you and your offer. And it does not matter who you are: a company with a century of history or yesterday’s entrant—silence is possible in both cases. Of course, reputation and recognition help—but only if you reach the right person at the right time, and there is no guarantee that this person will be among the 100 you selected. To ensure that, you must cover everyone who can afford it and be confident your message will not be lost in the flood of their incoming correspondence.

In other words, why delegate filtering to a platform that has no incentive to shorten your path to the end buyer? On those platforms, you are the product; it pays them to have you pour money in exchange for projections, clicks, and impressions. With us, you control who receives your message, and for the same spend you invest only in those who can become your client—if not today, then within a foreseeable window.

Finally, consider the long-term strategy gap. Look at platform architecture and the way impressions are distributed within a “targeted” audience. I hope it is now clear that no matter how sophisticated your targeting settings are, the final list inevitably includes a large fraction of people who cannot afford your offer—which means you accept from the outset that most of your budget will be wasted. Then, if you run recurring campaigns, how do you know who sees your message the second, third, fourth… time? Machine logic favors the more active users—they say so openly: “…based on your target audience, schedule, budget, member activity, auction dynamics, and more.” But you understand that high activity rarely correlates with high purchasing power in our segment—if anything, the relationship is inverse; the truly capable are often less active. Sometimes the first meaningful reply arrives after 15, 20, or even 30 campaigns. Thus, each subsequent time your ad is shown to an audience that is less and less relevant in terms of your expected outcome—but more relevant from the platform’s perspective, so the metrics match the projection. That these people ultimately buy nothing from you does not concern the platform. And, apparently, you do not fully grasp it either, since you keep paying for what at best generates superficial noise that may indirectly lead to transactions—and that becomes your justification.

If you are interested in real sales and in cultivating relationships with real buyers rather than intermediaries, pay attention to the products offered by UHNWI Data; they are designed specifically for categories aimed at ultra-wealthy buyers. We understand it is hard to break your dependence on platforms and to overcome distrust. BUT since you are, in any case, not getting the expected result and your assets remain unsold despite an abundance of Impressions, CTR, Views, Clicks, Leads, and CPL, perhaps it is time to try something new. Start with a $950 test mailing: if nothing comes of it, you have lost nothing—because you would have spent the same money on a platform not designed to promote ultra-expensive products.

Buy a test mailing to 100 UHNWIs.